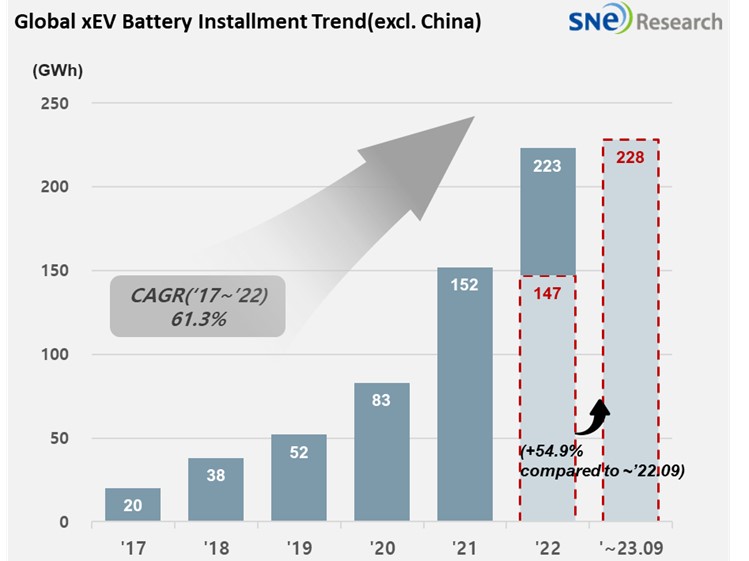

From Jan to September in 2023, Non-Chinese Global[1] EV Battery Usage[2] Posted 228.0GWh, a 54.9% YoY Growth

- K-trio accounted for 48.3% M/S

Battery installation for

global electric vehicles (EV, PHEV, HEV) excluding the Chinese market sold from

January to September 2023 was approximately 228.0GWh, a 54.9% YoY

growth.

(Source:

Global EV and Battery Monthly Tracker – October 2023,

SNE Research)

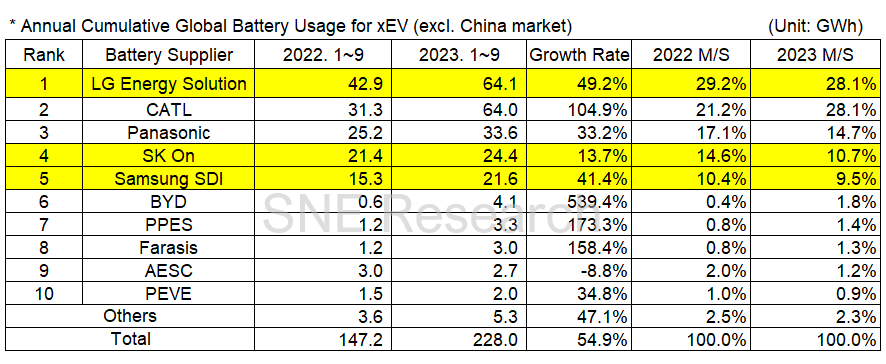

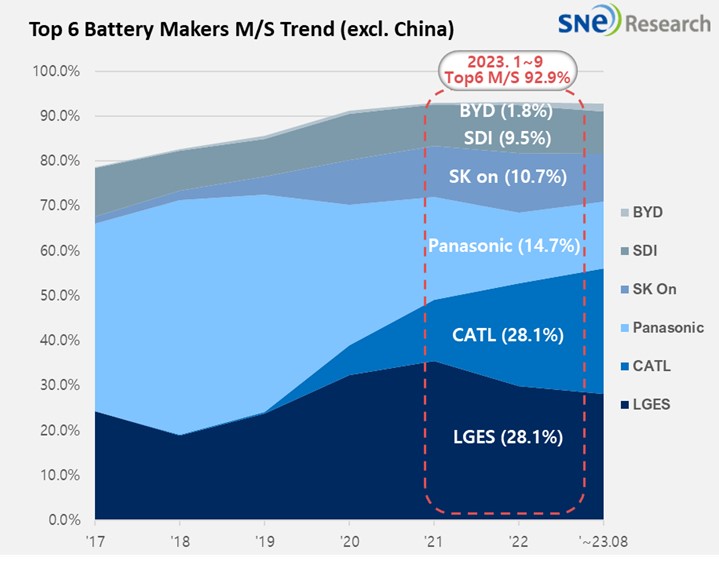

In the ranking of battery usage for electric vehicles, the K-trio battery makers all ranked within the top 5. LG Energy Solution maintained the top position with a 49.2%(64.1GWh) YoY growth. While SK On took the 4th place with 13.7%(24.4GWh), Samsung SDI followed right behind with a 41.4%(21.6GWh) growth. CATL in China rapidly expanding its market share, recording a trip-digit growth of 104.9%(64.0GWh) for consecutive months.

The

combined shares of K-trio recorded 48.3%, a 5.8%p decline from the same period

of last year, but their battery usage was in an upward trajectory. Their growth

was mainly affected by favorable sales of electric vehicle models equipped with

batteries of each company. Samsung SDI kept its growth momentum

based on the increasing sales of BMW i4/i7 and Audi Q8 e-Tron as well as a decent

sales of Rivian R1T/R1S/EDV and FIAT 500. SK On posted a growth thanks to solid

sales of Hyundai IONIQ 5, KIA EV6, and Mercedes EQA/B. Recently, as it has been

reported that SK On reached a decent level of accomplishment in developing

prismatic and LFP battery, which is highly sought after in the market, the

company is expected to see a growth in its market share mainly in the North

American region. LG

Energy Solution posted the highest growth among the K-trio, driven by favorable

sales of Tesla Model 3/Y, VW ID. Series, and Ford Mustang Mach-E that are highly

popular in Europe and North America. GM, continuously

witnessing a slowdown in sales, is reported to have a plan to expand its EV

line-up and production volume in earnest, based on battery produced by Ultium

Cells, its joint venture with LG Energy Solution. As GM is going to launch

electric vehicles such as Blazer EV sold at affordable prices, it is expected

to be leading the growth of LG Energy Solution.

Panasonic

registered the battery usage of 33.6GWh, 33.2% up from the same period of last

year. Panasonic, who is one of the major battery suppliers to Tesla, has most

of its battery usage installed in Tesla models in the North American market. Tesla

Model Y of which sales rapidly soared compared to the same period of last year

has driven the growth of Panasonic.

(Source: Global EV and Battery Monthly Tracker – October 2023, SNE Research)

One of the major reasons for recent slowdown

in the global EV market is pointed out as high interest rate and high price of

electric vehicles. Coupled with the sentiment of consumers who seek for

cost-effective vehicles, a recent tendency to move toward LFP battery with

price competitiveness is expected to increase the ratio of entry-level EVs sold

among the entire EV sales. Particularly in Europe, where the usage of LFP battery

is low, attentions should be drawn to changes in the market shares of Chinese cell

makers, having a strong will to enter overseas markets, and possibly

consequential changes in the usage of LFP battery.

[2] Based on battery installation for xEV registered during the relevant period.